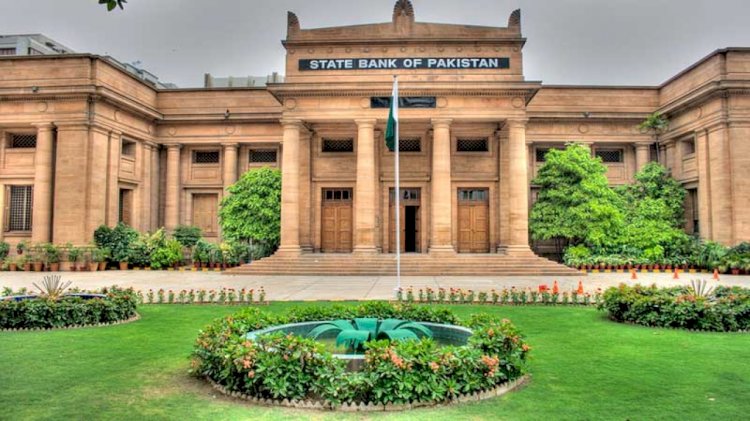

SBP Further Expands Scope of Refinance Scheme to Facilitate Industries.

“In addition to the new projects, existing projects/ businesses are being allowed to avail financing under these facilities for undertaking balancing, modernisation and replacement (BMR) and/or expansion of their projects/ businesses,†the State Bank of Pakistan (SBP) said in a statement. Since the beginning of outbreak of coronavirus, the State Bank of Pakistan has been […] The post SBP Further Expands Scope of Refinance Scheme to Facilitate Industries. appeared first on Nation Bytes.

“In addition to the new projects, existing projects/ businesses are being allowed to avail financing under these facilities for undertaking balancing, modernisation and replacement (BMR) and/or expansion of their projects/ businesses,” the State Bank of Pakistan (SBP) said in a statement.

Since the beginning of outbreak of coronavirus, the State Bank of Pakistan has been making efforts to support businesses and industries to mitigate the effect of the crisis. However, on March 17, the SBP had introduced TERF and its Shariah compliant version to stimulate new investment in the manufacturing sector.

On Friday, SBP has announced the opening of its subsidized Temporary Economic Relief Facility (TERF) scheme to expand existing projects as well as new projects. The scheme will provide concessionary loans to businesses for undertaking balancing, modernisation and replacement.

Furthermore, the state bank of Pakistan highlighted that it has expanded the scope of the refinancing facilities on the basis of feedback from stakeholders. Also, the central bank of Pakistan has directed all the banks, development finance institutions and borrowers are to ensure proper utilisation of the facilities.

“As per TERF’s/ITERF’s (Islamic / temporary economic refinance facility) eligibility criteria, financing for BMR/expansion will only be available for purchase of new imported and locally manufactured plant and machinery against foreign LC (letter of credit) and inland LC, respectively. Second-hand machinery, land or civil works are not covered under the facilities. Statement issued by SBP”

Banks/DFIs will be required to make disbursements to their customers on the basis of certificates of their internal audit confirming that financing is within the terms and conditions laid down in the facilities. A copy of the internal audit certificate should be submitted to the concerned office of SBP at the time of availing refinance for the first time for a project/ business while copies of certificates in respect of subsequent disbursements may be submitted at the time of availing last refinance for the same project/ business.

In case of consortium finance the lead bank will be required to submit the certificate.

The borrowers concerned will be required to submit a report from Pakistan Banks’ Association approved surveyors (acceptable to bank/DFI concerned) with regard to confirmation that the newly purchased plant & machinery has been installed as per their initial request/proposal for BMR/expansion. In case of installation/fixation in part, this report will be required at first and final installation of the plant/equipment.

Also Read: Think Tank is Formed by PM to Identify Factors to Boost Economy Amid COVID19 Downturn!

Source: The News

The post SBP Further Expands Scope of Refinance Scheme to Facilitate Industries. appeared first on Nation Bytes.