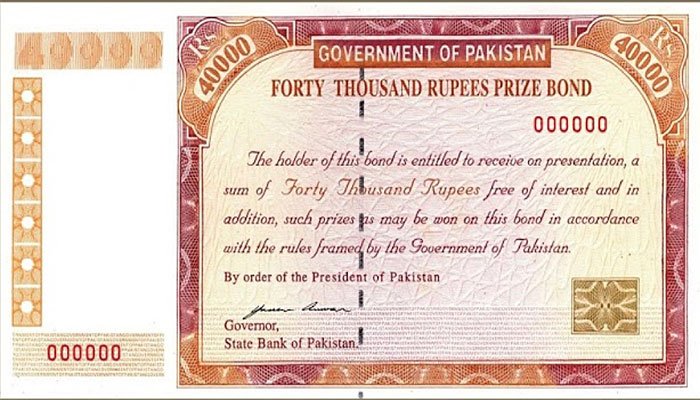

Records 21% Investment Growth In Rs.40000 Premium Prize Bond

The investment in premium Rs 40,000 prize bonds has seen a growth of 21% as compared to the last fiscal year

By the end of October 2020, the investment in premium Rs 40,000 prize bonds has seen a growth of 21% as compared to the last fiscal year. In the same period, the investment of Rs16.93 billion has seen last year while in this year the investment is Rs20.54 billion proclaimed by the Central Directorate of National Savings (CDNS) data.

In April 2017, the premium prize bonds were launched by the government to document the economy. The premium prize bonds of Rs 40000 are issued to those people who are having CNIC with valid bank accounts.

The government made it a more attractive investment bond, with the announcement of biannual profit, which would be directly transferred to the bank account of bondholders.

The investment in premium prize bonds is attractive now, as the government of Pakistan eliminated all unregistered prize bonds and unregistered debt securities. The step has been taken to ensure a verified source of income and to comply with the requirements of the Financial Action Task Force (FATF).

Read More: Federal Govt To Discontinue Rs 25000 Prize Bond

To stop terror financing and money laundering in early January 2020 the Ministry of Finance early January 2020 made it legal when it issued the “National Saving Schemes (AML and CFT) Rules, 2019”. The National Saving authority would collect all the information about bondholders who were investing in saving schemes. The information would include name, address, CNIC, passport, Bank account, etc.

In June, the total capital bonds of Rs 40,000 category was reduced to Rs756 million, but it again increased to Rs2.1 billion by the end of October 2020.