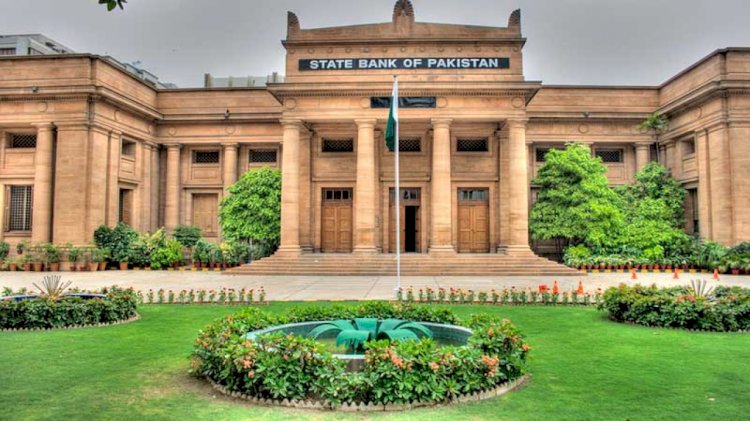

SBP announce Further Incentives for Businesses to Avoid Layoffs.

In the wake of the current outbreak of coronavirus, a number of companies are laying off their employees. However, to prevent the layoffs and to support the employers, SBP has introduced a refinance scheme on April 10th. However, on Wednesday SBP announces to provide additional incentives to the businesses to support employment. These additional incentives […] The post SBP announce Further Incentives for Businesses to Avoid Layoffs. appeared first on Nation Bytes.

In the wake of the current outbreak of coronavirus, a number of companies are laying off their employees. However, to prevent the layoffs and to support the employers, SBP has introduced a refinance scheme on April 10th. However, on Wednesday SBP announces to provide additional incentives to the businesses to support employment.

- These additional incentives includes the following:

- Relaxations in collateral requirements,

- Further reduction in end-user rate,

- Reimbursement of wages,

- Special accounts for employees to receive wages,

- Borrowing from banks other than maintaining payrolls,

- Simplification of application form for SMEs and bank’s exposure limits.

Furthermore, the reports suggest that these additional incentives are effective as of today.

Also Read: SBP Introduces ‘Refinance Scheme’ to Avoid Layoffs Amid COVID19.

Details of Additional Incentives.

SBP informed that SMEs including vendors and distributors were particularly facing the problem of providing security/collateral. To address this issue, the central bank has now allowed banks for providing financing against corporate guarantees of companies in value/supply chain relationships with the borrowers. Moreover, banks SBP encourages banks to provide loans without any collateral i.e. taking clean exposure of up to Rs5 million.

Secondly, the SBP has enhances the incentive to business which are active taxpayers. The bank reduces the markup rate for them to 3% which was 4% earlier. Now the SBP will provide refinance to banks at 0pc.

Thirdly, in order to facilitate employees for receiving wages under the scheme directly, banks have been allowed to open their accounts on the information and documents provided by the employers along with an undertaking stating that these persons are bonafide employees/workers.

Furthermore, SBP gives businesses the flexibility to avail loans under SBPs refinance scheme for wages from any bank. And they will not be limited to avail loans from the bank that manages their payroll. Further, businesses will also be able to get reimbursement of salaries pertaining to the month of April 2020 that have been disbursed through their own sources. If they have applied for financing under the scheme before disbursement and the same is subsequently approved by the banks. SMEs can apply for financing on a simplified loan application form prescribed by SBP for this scheme.

To facilitate the banks further for lending under the scheme, Banks’ exposure under the scheme has been exempted from the per-party limits. It will enable them to lend to borrowers that have exhausted their exposure limits.

The post SBP announce Further Incentives for Businesses to Avoid Layoffs. appeared first on Nation Bytes.